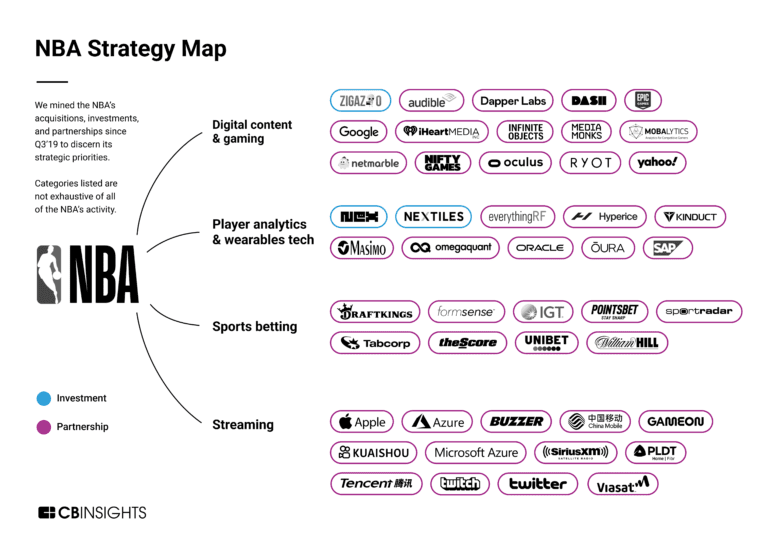

The NBA’s investments reached (and now I guess exceed) $1 billion last year. Making both cash investments and taking equity stakes in return for access to the league’s platform, the NBA is a variety of sports sectors: technology, media, data analysis, apparel, fan engagement and betting. There is a common theme in that, the NBA is selectively targeting early and growth-stage companies but beyond that the theme seemed unclear. Also, it seemed off-court for a league which has come a long way by being super focused on getting the core things right – Product, positioning, distribution and monetisation.

However, the league has earned its spurs as a tech leader. Its invitation-only Tech Summit competes with courtside as one of the hottest ticketsof All-Star weekend. It has always showcased the brightest and best of tech from holograms and 3D cameras to the in-game avatars and streaming Adam Silver brought to fans this year.

Pipeline isn’t going to be a problem with the League’s fame and incomparable billionaires club of owners. I wonder how David Lee, the Ex Bain and SK Capital leader of the league’s venture arm deals with his inbox. From tech entrepreneurs Steve Ballmer, Mark Cuban and Joseph Tsai, of Alibaba to Investment giants like Tony Ressle and Josh Harris who co-founded Apollo Global Management, Inc. the League’s owners are together worth north of $250bn. Safe to say they’re a well-connected bunch.

We’re not a purely financial investor. That’s not what we’re trying to do here. What we are trying to do is identify companies that are really focused on something that fits strategically with the NBA with our brand with our business model, where we can align with them investing in the company to help spur innovation, help them develop products that are going to benefit our fans, benefit our customers, help them use the NBA’s brand and all the assets that we can bring to the table to really grow their business and continue to support the growth of the game and that we think has been really, really successful strategy for us.

David Haber, the NBA’s chief financial officer Tweet

Sorare, the NFT provider epitomizes the NBA’s investments. The company, which recently raised $680 million, aligns with the NBA’s global outreach, extending fantasy games to fans in over 185 countries. The collaboration isn’t just a business transaction; it’s a long-term partnership aimed at growing together. It is Baseball Cards for the modern young consumer.

Nextiles, a smart fabrics company is interesting too. Birthed from the NBA’s Launchpad incubator program, Nextiles embeds sensors into fabrics to harvest performance and biometric data, a testament to the league’s drive for innovation in sports technology.

The narrative is clear; the NBA is not just a sports league. It’s morphing into an entity, that will drive its own future touching various sectors from technology to apparel.

In the grand scheme, as the NBA nurtures these companies, it’s creating a narrative that extends beyond the basketball court, projecting a vision that intertwines with the evolving dynamics of sports, technology, and fan engagement.

We are YEG! the GCC’s leading sports, MICE, and cultural events agency. We work with blue chip clients and government on travel, sports, conferences and celebrations.

Contact us here